December 2024 - Funding, Financial Kayfabe & Serial Founders

This month, Charlie discusses why Bounce raised venture funding and Jack Pierse's new gig, while Paddy dives into a theory on global equity markets and Omnea's $20M Series A.

The Double Nudge: A relatable guide to personal growth

The words in this newsletter are entirely our own, but the insights and ideas have been inspired by others. Our goal is to synthesise the best information we have consumed each month, and relate it to our everyday lives.

This is our attempt to get better each day, and we would love you to join us.

Quote of the Month: "And now that you don’t have to be perfect, you can be good." John Steinbeck

Our Challenge of the Month - Raising $4.5M in Venture Funding:

This month, we announced our $4.5M funding round at Bounce led by ACT Venture Capital to continue shaking up the market research industry and accelerate our expansion in the US. In future editions, I will take you through our plans with the funding, but discussing why we raised this money in the first place felt like something that isn’t spoken about much by founders.

One of the things I’ve worked on over the last few years is being more open minded, and having the capacity to change my view. The quote “strong opinions, weakly held” is something I’ve gravitated towards in recent years as I mature and take on new information. Most of the people I admire have this quality, so I feel it’s something I should be cognisant of in my day-to-day life.

If you spoke to me back when I started Bounce about my opinion on venture capital, I would have launched into a scathing review of people who do things versus people who tell people what to do. Putting it simply, how could anyone who never built a company possibly know how to invest in a company?

Going through the process of raising approx. $6M in funding over the last few years has led me to meet a wide range of investors, including angels, syndicates and venture capitalists. Before making the decision to raise institutional capital, I also researched a lot and met founders I trusted who had done it before to understand the pros and cons.

Venture funding is not for every start-up. However, at Bounce, we didn’t need to raise money, we wanted to. We felt compelled to execute at speed given the opportunity that was presenting itself right in front of our eyes. We felt uniquely positioned to win in a large market that was ripe for disruption. From what I learned in my research, that is exactly the time to raise venture money, so we did.

It was only in understanding how venture actually works, that I realised we had more in common than I thought a few years prior. In the investors leading this round, we found great people who get great outcomes. In a privately owned company taking on risk capital, that is what matters.

Outside of that personal area of growth over the last few months, going through the process of raising venture capital did exceptional things for me in understanding how we will get an outcome in the future. It is a surgical examination of your fundamentals as a business.

This invasive procedure does a few important things:

It forces you to be data-obsessed, understand every important metric of your business and what influences it. Andy Grove “what can’t be measured, can’t be managed” rings true here.

It provides you with ultimate focus, prioritising the things that actually matter, allowing you to ignore everything else as an executive team.

It brings clarity and alignment to the entire company as you are forced to clearly articulate a vision for the future, and how additional capital is going to help you get there, and how you will be measured towards that end goal.

Of course, these things can be done without venture money, but there’s nothing quite like a third-party who reviews hundreds of companies a year as the surgeon beside you at the operating table, poking and prodding to ensure there are no gaps on the above.

The drawback to raising venture funding is simple. It is long, hard, repetitive and takes time away from the founders of the business at a critical point in your journey. It is a necessary evil, and despite my gripes, I wouldn’t change anything about our decision to take this money on. I have never been so excited to go into work every day, I am deeply confident that we will do something incredible over the coming years, and that fills me with immense gratitude.

It is everything that I dreamed of when I stepped into that room in Trinity College alongside my co-founders over five years ago. Now, we have the privilege and the capital to take the next step on our journey. It’s time to get to work.

Our Trend of the Month - Kayfabe in Global Equities Markets?

Netflix’s latest hit show Mr. McMahon focuses on the WWE’s and larger than life promoter Vince McMahon. The show captured my attention recently when under the weather.

Generally, the world of wrestling is not a super relevant place to learn, but this time I took a lot from Kayfabe. Kayfabe is the terminology used for maintaining the illusion that everything is real instead of staged. It is the unwritten contract between professional wrestlers and their fans that the stories and characters are genuine and things are as they seem.

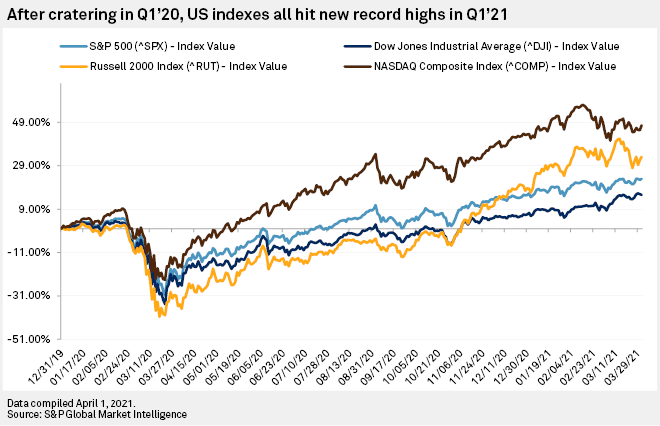

It got me thinking about the parallels in global equity markets. In recent years, despite often feeling like everything has been falling apart, global stock indices have rallied to record highs.

Source: S&P

However, in reality, since 2020, central bankers have flooded markets by printing lots of money. In nominal terms, everyone is feeling very wealthy, but in real terms that is perhaps not the case (after the currency debasement of the added liquidity).

As seen in the chart above, the Kayfabe has been going on since 1971 when the US came off the gold standard and increased in recent years.

Since the Global Financial Crisis, markets have been flooded with liquidity. Over that time stock markets had a CAGR of c.5.8% which was outpaced by the money supply increasing at c.7.2%.

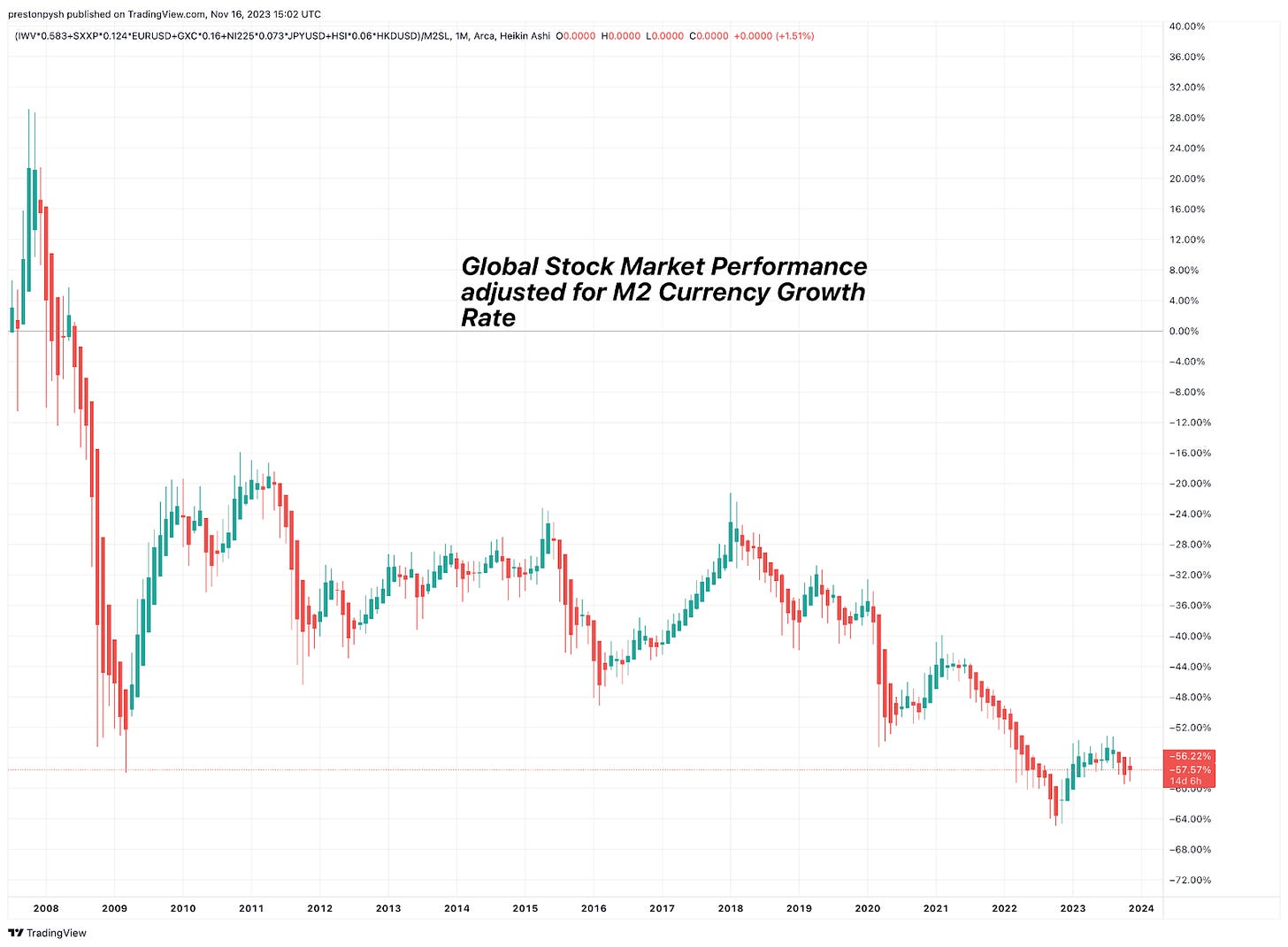

Source: Preston Pysh analysis

Things take a rather different complexion when adjusting stock market performance for this increase in the money supply.

Source: Preston Pysh analysis

For now, most economic participants remain immersed in the show and enjoying their nominal returns. At the same, there is a cohort of viewers that are no longer buying into the Kayfabe and instead have changed their unit of account.

There now is a canary in the coal mine. Once you change your unit of account, things take a rather different complexion and the show is not so fun.

Start-Up / Founder of the Month - Jack Pierse of Wayflyer, HappyStack & Bold Golf:

Without a doubt, one of the most successful Irish start-up stories of the last decade has been Wayflyer. The company recently won the fastest growing technology company in this year’s Deloitte Technology Fast 50 Awards and became the sixth company in Ireland to achieve unicorn status in 2022.

Now, their co-founder, Jack Pierse who exited the company in the summer of 2023 to pursue new ventures has unveiled two of them in recent months. First, Bold Golf which has taken investment off Shane Lowry to build a high-end streetwear and sporting equipment brand. Second, HappyStack where he has joined forces with early team members at Wayflyer, Joe Bollard, Dan O’Brien & Jamie Khan to build “the world’s best e-commerce stack” for D2C brands.

E-commerce is a sector that has taken a beating in recent years, as the co-founders of HappyStack know well, it’s “a game of tight margins, high stress and constant change”, so they want to solve the operational problems that inevitably arise for these companies.

I know from Jack’s speech at Web Summit this year that they’re unlikely to raise venture money, but they certainly wouldn’t struggle to find money to build unicorn number two if they sought it. They’re also gathering some muscle to help them execute, recently bringing on Charlie Gleeson who built and sold Zipp Mobility, and headhunting Sean McHugh back from Australia.

Jack is one of those founders who cares deeply about creating an ecosystem that thrives in Ireland. He has written clearly on Ireland's diversification issue where today, over 60% of Ireland’s Corporation Tax receipts come from 10 companies, while 53% of all Payroll Taxes come from Multinationals - a disaster waiting to happen.

He was also early and public in his anger on the NDRC closure in November, a short-sighted decision to shut one of Ireland’s best accelerator programmes for start-ups. In a time where Ireland needs to encourage indigenous companies to flourish, Jack is walking the walk and talking the talk. I’ve no doubt he’s inspiring the next generation of great founders.

To dive in more, his podcast with Gary Fox is a cracking listen, and Charlie Taylor’s article on HappyStack is worth a read.

Investment / Fundraise in Focus - Omnea:

I’ve long admired investment bankers who transitioned into tech, especially given my recent exit from banking. Ben Freeman is one of those people and his company Omnea recently raised a stellar $20m Series A led by Accel.

Omnea is a procurement and supplier management platform. They enable their customers to holistically manage the full supplier lifecycle and provide a single source of truth for all supplier data as currently, business purchases are completely broken.

An average B2B purchase takes over 3 months, needs 50+ emails and involves multiple stakeholders. This takes time away from operating and focusing on your underlying business.

Additionally, a tougher macro climate in recent years since ZIRP has brought profitability back into focus as companies optimise their spending and streamline their operations using funds more efficiently.

Source: Dawn Capital

Clearly there is a need for a solution, as seen by the competitiveness of the space. Players like Zip in the US have executed incredibly well, resulting in a recent $190M Series D at a $2.2B valuation.

But Omnea is emerging as the latest potentially prominent player in the space, well positioned to fight for market share in Europe and beyond. He is slowly building a top-class team by attracting many of the leaders who helped scale Tessian from 5 to 200+ and go from $0m-$30m ARR, raising +$130m from leading investors such as Sequoia and Balderton in the process.

Omnea’s rigorous approach to attracting and retaining top ultra-competitive talent and running things extremely meritocratically may just result in the next large European tech company. It feels like the band is back together and the team is ready to execute on their vision.

P.S. The team is hiring fast, so if it sounds interesting, drop us a line and we can make an intro.

Content Corner:

The Power Law by Sebastian Mallaby here is a great read for anyone interested in the world of venture capital, and how it works.

Google’s New Quantum Chip, Willow, launched here, a leap forward in solving a key challenge that has persisted for almost 30 years. In addition, Willow performed a standard benchmark computation in under five minutes that would take one of today’s fastest supercomputers 10 septillion (that is, 1025) years.

Scaling People here, sent directly to me by a reader after my post last month, a cracking guide for managers by Claire Hughes Johnson (also an angel in Omnea)

Defensibility & Competition, a must-read for founders here by Elad Gil.

Former Stripe CTO David Singleton raises $56m for new start-up here, focused on developing an operating system for artificial intelligence agents

Can Europe build its first trillion-dollar start up here, a great piece on why Europe has failed and what needs to happen to set it right.

Breakthroughs of 2024, a great thread on some of the wins for humanity this year.

Inside the mind of second-time founders here as Irish founders Jules Coleman and Alex Depledge step into the ring again after selling their first start-up for €32 million in July 2015.

Analysis of UK stagflation, with many of these points also relevant to Ireland here.

Thought-Provoking Graphics:

The difference between the US & EU when it comes to building large, successful companies is staggering.

Fast walkers have a higher IQ than slow walkers.

We continue to trend towards demographic issues.

Gold price fluctuations when the Weimar was going through currency failure.

Memes: