January 2025 - Will, Willow & What Matters:

This month, Charlie dives into two key principles he follows at Bounce, while Paddy explores Google's latest advancements in quantum computing, plus much more.

The Double Nudge: A relatable guide to personal growth

The words in this newsletter are entirely our own, but the insights and ideas have been inspired by others. Our goal is to synthesise the best information we have consumed each month, and relate it to our everyday lives.

This is our attempt to get better each day, and we would love you to join us.

Quote of the Month: “Success is being excited to go to work and being excited to come home.” Will Ahmed

Our Challenge of the Month - Active Decisions & Funnel Focus:

I’ve learned a lot about the world and business from one of my co-founders, Rónán. I have never met someone with a greater ability to distil what actually matters, combined with a frightening standard of execution, no matter what the domain. He has changed the way I think through two of his core principles: active decisions and funnel focus.

Following our $4.5M funding round at Bounce, my biggest focus this month was to embody these principles. They are the ingredients of focus and execution, let me explain why.

In behavioural economics, ‘active choice’ refers to a decision-making strategy that involves making conscious and deliberate choices about what options to pursue. This sounds simple, but you’d be amazed at how rare it is in business. I believe most start-ups fail because they don’t follow a process of active decision-making, which requires deep thought about why you are doing what you are doing, and the evidence to confirm it’s the right thing to do.

I know this, because I was an inactive decision maker. Sometimes, I would be confident I was doing the right thing, but that would crumble when Rónán sought evidence for that decision, and we’d find out quickly it was a different path we needed to take.

Similarly, in running the commercial side of the business, the quicker you realise that everything is a funnel, the easier your life becomes. A funnel analysis is a method of understanding the steps required to reach an outcome. By doing this analysis, you know where to focus and more importantly, what to ignore.

At Bounce, we know our sales funnel metrics inside out, and they’re strong. In short, we win a high % of clients we engage with, in not a very long time. This means I need to trust the team to continue executing at that same performance, and focus my energy on how we’re going to drive the growth we need moving forward. This will be achieved by focusing on top of funnel (i.e. creating new client opportunities) and bottom of funnel (i.e. growing the spend of existing clients).

Suddenly, the fear and anxiety built at the start of the year when I saw the 2025 revenue target we have set dissipates. By making active decisions and having a funnel focus, the path becomes clear on where I need to focus. All that’s left to do is trust my numbers and execute.

These principles don’t just apply to sales. Take the example of raising a funding round. Most founders say they’re struggling to raise money or there’s not enough capital. Granted, a lot of companies are just not investible, but there are plenty I’ve met that simply don’t get these two principles.

When I ask them how many VC’s they’ve emailed, the answer is always shockingly low, but they think they’re doomed. Let’s do some simple maths. If you want 3 term sheets to try to close a round with some optionality, and expect a 10% conversion from pitch to term sheet, then you require 30 VC’s interested. Assuming a positive response rate to cold emails of 5%, you need to be emailing 600 VC’s who are specifically investing at your stage and type of business.

You might have a great business, but just aren’t working hard enough at the right things.

Our Trend of the Month - Google’s Development of Willow:

This month, the snowfall at Shannon Airport led to my flight being held on the runway for several hours. Thankfully, we had in-flight entertainment and a complex Sudoku kept me busy for longer than it should have.

Oddly, it was then that I started to appreciate the recent murmurs about the advancement of quantum computing. As I felt myself running through the numbers 1 to 2 to 3 and so far, I realised how much faster computations could be done through computers, or indeed quantum computers.

In regular computers, information is processed in bits: 1’s and 0’s. But, quantum computers use qubits which can exist as superpositions of both 1 and 0 simultaneously. As a result, quantum computers can conduct multiple calculations at once.

Google has been at the forefront of the quantum field after unveiling quantum processors like Foxtail (2017), Bristlecone (2018), Sycamore (2019), and now Willow (2024). Their new quantum computing chip Willow is septillions of times faster than a classical computing chip.

Willow can do tasks in 5 minutes than would take a classical computer 10 septillion years (10,000,000,000,000,000,000,000,000). More simply, a regular computer could solve the Sudoku much faster than me, and a quantum computer makes a mockery of a regular computer.

Quantum stocks appear to be the hot thing right now and quantum equities have rallied hard throughout H2 last year.

However, in reality, it seems we are still quite a way off from a paradigm shift. Although, Google’s recent developments with Willow are a notable leap forward. Jensen Heung recently suggested a 10+ year timeframe, hopefully offering enough time to prevent widespread disruption to financial markets.

If quantum does indeed arrive slowly the law of slow-moving disasters offers protection - if we can see a problem coming from far ahead, we’ve always been able to fix it in time to avoid it.

My Sudoku skills are safe for a little longer.

Start-Up / Founder of the Month - Will O’Brien, Ulysses Ecosystem Engineering:

It’s always funny writing about people you know, but the longer I spend running in start-up circles, the more exceptional founders you meet. I’ve also seen an increase in friends of mine not only interested in joining start-ups, and asking me for advice on which companies to join, but launching their own companies.

Someone who was always going to launch his own thing is Will O’Brien, a uniquely brilliant entrepreneur who has recently launched Ulysses Ecosystem Engineering alongside Colm O'Brien, Akhil Voorakkara and Jamie Wedderburn to build autonomous robots for the ocean. Their first mission is to restore seagrass ecosystems that foster biodiversity and draw down carbon from the atmosphere.

The company recently re-located to San Francisco citing a better pool of engineering talent and a culture of excellence that bleeds out of the American west coast. They recently closed $2M in pre-seed fundraise led by Lowercarbon Capital, Superorganism, the world’s first biodiversity VC, ReGen Ventures, an investor in planetary-scale regenerative technologies, as well as two of the founders of one of Ireland's best recent success stories, Intercom.

To understand why there is so much excitement about this company, I’d highly recommend listening to Will’s interview on Gary Fox’s podcast here, where he articulates why he believes the ocean has vast untapped potential for innovation, why great ideas are underrated and despite his love for Ireland, why San Francisco was a necessity for their ambition.

Since their PR splash in November 2024, Will’s thoughts often find themselves on his X account, which is well worth a follow. It’s a blend of progress updates at Ulysses, Eire accelerationism, embracing contrarian ideas, Guinness, advice for other founders or simply, good gags.

The founding team at Ulysses are building something great, and having fun doing it, which is something every founder should learn from. Best of luck gents.

Content Corner:

Fergus McCullough has a great piece here on an incomplete list of essays and books on company culture.

I am rich and have no idea what to do with my life here, a fascinating read from a recently exited founder who has been left with more questions than answers after reaching financial freedom.

Irish tech firms raise $500M+ in one week in January here, including FIRE1, Deciphex, LetsGetChecked, Mail Metrics, Dataships and XOCEAN.

Irish tech veteran Sean Blanchfield raises €4M for AI start-up, Jentic here. The previously co-founder of PageFair and Demonware returns with a plan to simplify AI development and deployment.

Tim Ferris launches first book in seven years here, that aims to detail the exact strategies, philosophies, word-for-word scripts, tech, and more that he and others use to create focus, calm, and meaning in a world of overwhelming noise.

The Revival of the NDRC Accelerator here, following backlash of its proposed closure at the end of 2024. A new government has committed to it’s revival and continued investment in the entrepreneurial ecosystem in Ireland.

DeepSeek shocked the world this month with their cost-effective R1 model, Karpathy’s tweet from last month is worth a revisit here.

Thought-Provoking Graphics:

Are you really diversified or do you even want to diversify?

A timely graphic given aspirational new year’s resolutions.

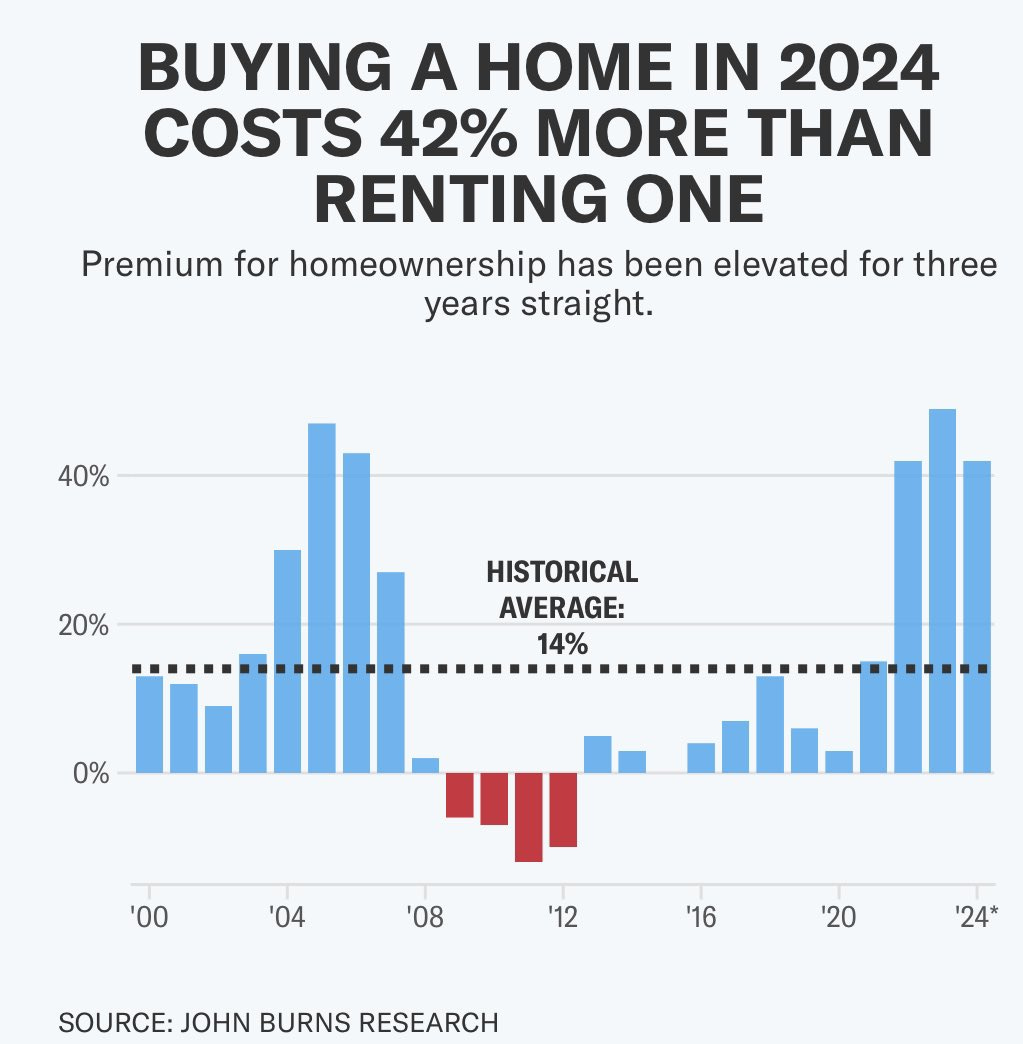

To buy or to rent? In The Netherlands the decision is becoming more clear.

Memes: